Sorry for the lengthy lapse in posts! I have been very busy helping clients! Over the past few months, East Bay real estate has been a whirlwind. The combination of low interest rates, high rents, and a surge in desire for homeownership has once again created a sellers market. Prices in communities of Oakland and Berkeley are still not at the peak prices of 2005 through 2007, but they are up from the steep decline of 2008, 2009, 2010 and 2011.

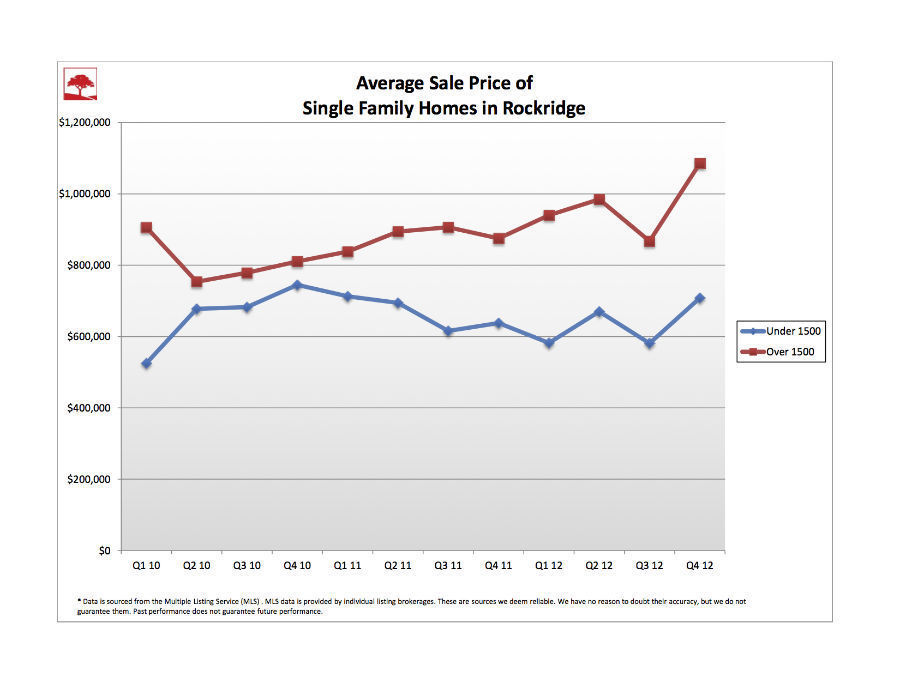

The biggest equity gains in Oakland have happened in the the walkable areas such as Rockridge and Crocker Highlands. (See the stats for these neighborhoods at the end of this post.) As more buyers migrate to the sunny side of the Bay from San Francisco, a higher demand is placed on a home with an easy walk to coffee, restaurants and public transportation. Lifestyle can often trump home size in importance.

For buyers it is important to consider that interest rates will likely rise as the economy improves. This historic window of "cheap" money will not last forever. As a buyer, if you plan to keep your new home for a long time, you can count on keeping that fixed rate, low interest loan and will maximize the savings. I suggest that my buyers consider purchasing a home that will fit their needs for a minimum of 7 years.

Is now still a good time to buy even when buyers must compete, and prices can go substantially over the original asking price? My answer is yes. Consider this. A listing price is a marketing tool. Many sellers decide to price their homes under its expected sale price to gain maximum exposure during the period the home is marketed to the public. Using this tactic often means that a seller with a home that might be worth $800,000 will price it at $720,000. When a buyer offers $80K over the asking price, their offer is actually spot on in regard to value. But stopping there does not take the competition into consideration. With multiple buyers offering to buy the same property, it is often necessary to bid even higher than fair market value to win the home. What a buyer should factor into the equation while they ponder what price to offer is, the record low interest rates. At a 3.75% interest rate on an offer of $811,000 and a buyer just might beat the competition by offering a few thousand dollars more. For example, the monthly payment with a 20% down payment, (not including property taxes and insurance) would be $3004.69.

What's the risk in waiting? Using the same example, if the interest rates rise to 5%, (still a great rate!), your monthly payment would be $3482.90. That equals a $480 per month increase for the same loan. It equates to an additional $5760 per year and $40,320 over a seven year time span. If you decided that you wanted to keep your payment down to the $3000 per month range and interest rates went up to 5%, your buying power would equate to a purchase price of $700,000 as opposed to $811,000- decreasing by over $100K. The risk here is that there is no guarantee that home prices will decrease accordingly by 7%.

A final factor to consider is whether you will benefit from a tax deduction. For example, if you make $100,000 annually and pay $30,000 in mortgage interest, you will be able to deduct that cost from your income for a substantial savings. (Please consult your tax adviser for the exact tax saving).

Ultimately home ownership is a personal choice, and a big investment. As you consider whether buying a home at this time is right for you realize the numbers are now showing that the current market is in a sweet spot. The prediction moving forward is that prices and interest rates are on the rise...